When it comes to managing your money, setting goals is an essential first step. But with so many different financial goals to consider, deciding which ones to prioritize can be challenging. This article will provide you with strategies for prioritizing your financial goals and achieving success.

|

| How to Prioritize Your Financial Goals Strategies for Success |

Understanding Your Financial Goals

Before diving into prioritization strategies, it's essential to understand the different types of financial goals and how they relate to your overall financial plan. Your financial goals can generally be classified into three categories:

Short-Term Goals

You plan to achieve short-term financial goals within the next year or two. You can save money for a vacation, pay off your credit card, or build an emergency fund by setting short-term goals.

Mid-Term Goals

Mid-term financial goals are those that you plan to achieve within the next three to five years. Examples of mid-term goals include saving for a down payment on a home or a child's college education.

Long-Term Goals

Long-term financial goals are those that you plan to achieve over an extended period, usually several decades. Examples of long-term goals include saving for retirement or paying off a mortgage early.

Your financial goals are the roadmap to your dreams. Prioritize them wisely and watch your aspirations come to life.

Understanding the Importance of Prioritization

Before diving into the strategies, let's take a moment to understand why prioritizing your financial goals is so essential. By setting clear priorities, you can:

Stay Focused: Prioritizing your goals helps you stay focused on what matters most, avoiding distractions and unnecessary expenses.

Make Informed Decisions: When you know your priorities, you can make informed decisions that align with your long-term goals.

Stay Motivated: By having a clear sense of what you want to achieve, you'll feel more motivated to work towards your goals, even when faced with challenges.

Track Progress: Prioritization allows you to track your progress and celebrate milestones along the way, boosting your confidence and momentum.

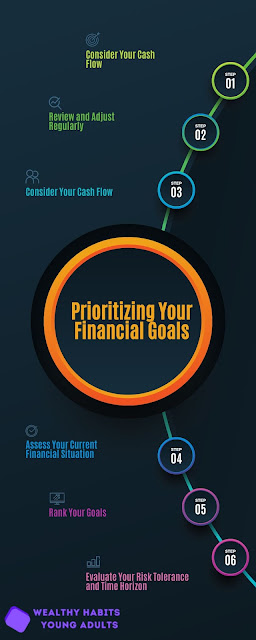

Prioritizing Your Financial Goals - A Step-by-Step Guide

Once you understand the different types of financial goals, you need to prioritize them based on what is most important to you. Here are some strategies for doing so:

Assess Your Current Financial Situation

Before you can effectively prioritize your financial goals, it's essential to assess your current financial situation. Make sure you have a clear picture of your income, expenses, debts, and savings. Determine your net worth and evaluate your cash flow. This analysis will give you a clear picture of where you stand and help you identify areas that need improvement.

Rank Your Goals

Make a list of all your financial goals, starting with the most important. Rank them based on their priority and how much they align with your overall financial plan. You may find that some goals are more critical than others, and they will require more attention and resources.

Evaluate Your Risk Tolerance and Time Horizon

When setting priorities for your financial goals, it's essential to consider your risk tolerance and time horizon. You may prioritize more aggressive investing goals if you have a high-risk tolerance. On the other hand, if you have a low-risk tolerance, you may prioritize more conservative goals. Similarly, your time horizon will determine how long you can wait to achieve a specific goal.

Consider Your Cash Flow

Another crucial factor to consider is your cash flow. You may have a list of financial goals, but not all of them may be achievable based on your current income and expenses. Consider how much money you have to allocate to each goal and which goals you can afford to prioritize.

Review and Adjust Regularly

Your financial priorities may change over time, so reviewing and adjusting them regularly is crucial. Make a habit of checking in on your financial goals and making adjustments as necessary.

Align with Your Values and Priorities

Your financial goals should align with your values and priorities in life. Consider what truly matters to you and how your goals can contribute to your overall well-being and happiness. By aligning your goals with your values, you'll find it easier to stay committed and motivated throughout the journey.

Continuously Review and Adjust

Financial priorities can change over time, and it's essential to review and adjust your goals regularly. Life circumstances, economic factors, and personal aspirations can influence your priorities. Stay flexible and be willing to adapt your financial goals as needed.

Conclusion

Prioritizing your financial goals is critical to achieving financial success. By understanding your financial goals and adopting the right strategies to prioritize them, you can make significant progress toward a stable financial future.

FAQs

How many financial goals should I prioritize at a time?

It's best to focus on no more than three to four financial goals at a time to avoid spreading yourself too thin.

What should I do if my financial priorities change?

Review and adjust your goals regularly to ensure they align with your current financial situation and priorities.

Should I prioritize short-term or long-term goals?

As far as your financial situation and goals are concerned, it ultimately depends on you. While short-term goals may provide more immediate gratification, long-term goals are essential for long-term financial stability.

How do I determine my risk tolerance?

Consult with a financial advisor or use an online risk tolerance assessment tool to determine your risk tolerance.

How often should I review my financial goals?

Review your financial goals at least once per year or whenever your financial situation changes significantly.